Financial Structure Architects: Build Your Personal & Business Foundation Before You Chase Funding

Stop Chasing Funding Without a Proper Financial Structure

📚 Your Free Business Funding Kickstarter challenge Includes :

✅General 2026 (12 Credit Freedom Playbooks)

✅Premium First-Round Al Bot Forensics Logic

✅Credit Freedom Deletion Tracker

✅business credit setup + Generating Capital From Closet & Home

✅ 30-days revenue kickstarter

🚨 Participate in the Free Business Funding Challenge.

The 12 Credit Freedom Playbooks:

✅ Business Structure formation & Business Credit Setup

✅ Credit Restoration for Medical Debt

✅ Credit Restoration after Student Loans

✅ what are Resold Portfolios & Debt-Buyer Tactics you need to know

✅ Restoring credit after Judgments / Child Support / Repossession Deficiency

✅ Instructions for Credit Restoration In Bankruptcy Aftermath

✅ Credit Repair & Restoration for Identity Theft Victims

✅ Credit Restoration with Inquiry Removal Logic

✅ Arbitration Assistant Flow for advanced disputes

✅ Debt Settlement (Collector-Style: Challenge first, Settle only when they prove 100%)

✅ Credit Bureau Dispute Mastery Playbook

✅ (Start with $0) 30-days revenue kickstarter to retail arbitrage.

✅ Bonus Playbook: Grant and reimbursement

Business Funding Challenge = Personal Credit + Business Credit + Revenue Setup + Grant Assistance

Important Note on the 1244 Protocol:

IF you choose to schedule it after getting the free playbooks, Ask us on our call:

What can the FULL 1244 Violation & Error List (Or the 400+ portable list) do that these playbooks won't be able to do alone?

Understanding this specific list of compliance errors is the difference between a "dispute" and a "deletion."

We’ll show you how to find these errors on your own file during our 15-minute Strategy Mapping. If you choose to schedule it after getting your free playbooks.

Where most people stop in the process … is exactly where we specialize.

Financial Freedom: The Big Picture 💰✨

The goal of mastering the 5 C's is not just getting approved; it's achieving financial freedom.

Our mission is to help you build that freedom by giving you the tools to succeed:

-

🔧 Repairing and building your personal and business credit so you can leverage funding externally.

-

💼 Monetizing your talent, time, and unused assets through retail arbitrage and service exchange on the platform.

It all starts with understanding these five basic concepts. By strengthening your Character, Capacity, and Capital, you gain control over your financial future. 🚀

🚀 The 5-Step Ladder to a Six-Figure Loan: Why Banks Keep You Waiting!

Hold on to your excitement! Filing business paperwork is Step One, but here’s the tough truth the banks won't tell you: Starting a company does not automatically qualify you for $50,000, $100,000, or $250,000 in funding. They omit this information because they want you to believe the money is easy, when in reality, you have to build the foundation first.

Financial freedom is a step-by-step climb. You need to build your business profile like a video game character—starting from Level 1 and unlocking powerful assets as you prove your worth.

Here is the 5 C's Ladder that turns a new business into a powerhouse borrower:

1. Character (Level 1: Proving You’re Trustworthy) 🧩

What It Is:

This is the bedrock—your financial reputation. You are a new character on the scene, and you must prove you are honest and responsible.

The Level-Up:

This starts with credit repair on your personal profile. Every bill paid on time, every debt managed ethically, legally, and by the book. It’s about creating a long, clean track record that tells the bank: "This person intends to pay back their debt."

🎯 Next Step: Now that your record is clean, it's time to generate funds.

2. Capacity (Level 2: The Cash Flow Engine) 💸🔥

What It Is:

Your ability to generate and manage cash flow. A trustworthy person (Character) needs to show they can actually afford the new payment.

The Level-Up:

This is where your monetizing talent and time comes in! You are working gigs, selling assets, and building revenue. As you make profits, you consistently deposit money into your business bank account. You are proving high Capacity—more money coming in than going out.

🎯 Next Step: Use that profit to build your capital and lock down your commitment.

3. Capital (Level 3: Putting Skin in the Game) 💼💰

What It Is:

Your personal investment—the money you or your business have successfully generated and held.

The Level-Up:

Because you’ve been diligent (great Character) and made profits (strong Capacity), you now have significant Capital. This is your "skin in the game." If you’re willing to invest $20,000 of your own capital into a project, banks are much more willing to lend the other $80,000. It shows you believe in your success.

🎯 Next Step: Leverage your good credit and capital to acquire massive assets.

4. Collateral (Level 4: The Major Milestone) 🏠📊

What It Is:

The asset the bank can seize if everything goes wrong—their insurance policy.

The Level-Up:

Your strong Character and accumulated Capital allow you to obtain major assets (real estate, large equipment). That asset becomes your Collateral. Now you have a verifiable asset you can borrow against. This puts you in a powerful position to finance even bigger projects.

🎯 Next Step: Achieve the status of “approved for anything” by proving consistency.

5. Conditions (Level 5: The Ultimate Approval) 🏆📄

What It Is:

The final approval based on all previous steps aligning with the bank's goals and the current economic climate.

The Level-Up:

Because you executed every step ethically, legally, and on time—proving Character, maximizing Capacity, investing Capital, and securing Collateral—your profile now screams "low risk."

The Conditions are perfect. Major funding becomes inevitable.

This isn’t overnight success—it’s the reward for building the ladder one step at a time!

🗝️ Your Financial Freedom Starts Now

Understanding and mastering the 5 C's is the difference between getting denied and getting funded. You have the tools to begin this journey today by monetizing your talent, time, and unused materials (retail arbitrage) and by fixing and building your credit profile.

This is the foundation for lasting financial freedom. 🌟

💭 When was the last time you got Approved for something you truly desired?

Why Choose Us

12

Years of Experience

In Business Funding

4

Expert Advisors

1

Locations

Al Dareshore is the founder of Dareshore, a company specializing in business funding and credit restoration services. Al began his journey in the United States in 2007. Like many immigrants, he faced significant challenges and had to learn important lessons along the way. Initially his personal credit got damaged due to making financial mistakes and inexperience. This compelled him to learn step by step how to restore his credit as he was working in debt collection industry. In the process, while searching for alternatives to progress, he discovered the world of business credit—a field that later became his focus. With over 12 years of experience in the credit industry, AL transitioned from debt collection to focus on consumer credit restoration & Business funding. He leveraged his extensive knowledge to help clients overcome financial challenges. He designed a comprehensive system that not only restores personal credit but also enables individuals to benefit from the advantages of business credit. Under Al Dareshore's leadership, Dareshore has expanded its services to include real estate investment, reflecting his multifaceted vision for the company. His commitment to providing straightforward and transparent services, combined with a focus on securing necessary funding for clients, has played a key role in the company’s growth and success. Al Dareshore remains committed to empowering individuals and businesses through financial education and support. He continues to lead Dareshore’s mission, helping clients achieve their financial goals and build a solid foundation for a better future.

Why Dareshore.com?

🚀 Real Expertise

Former debt collectors who know the system inside-out and leverage insider knowledge to challenge negative items effectively.

⚡ No Overpromising

We get you funding-ready, not just “apply and hope.

📈 Long-Term Success

Your future financial freedom starts today.

You Don’t Need Credit Repair

You Need Funding Preparation.

Personal Credit Restoration + Business Credit Setup

Become Lendable. Get Funded.

Move Your Business Forward.

Your journey to financial freedom and business funding starts with one crucial step: optimizing your credit profile. At Dareshore, we don’t just repair credit—we strategically position you for long-term financial success so you can access funding when you need it most.

Build Strong Credit & Unlock Business Funding with Dareshore

FUNDING ASSISTANCE

What It Includes:

-

Expert funding applications and lender negotiations.

-

Guidance on maximizing approvals and securing the best terms.

-

Post-funding support to help you manage and grow your business.

For Entrepreneurs and business owners who need $50K-$250K in funding and already have excellent personal credit and a compliant business profile.

PERSONAL CREDIT RESTORATION

Individuals with no or poor credit who need to remove negative items, add positive history, and rebuild their credit to qualify for funding or other financial opportunities.

What It Includes:

-

Credit Restoration: Fix inaccuracies, remove negative items, and rebuild your credit profile.

-

Debt Settlement: Negotiate and resolve outstanding debts for a fresh financial start.

-

Adding History: Establish aged tradelines to boost your credit profile and meet funding requirements.

BUSINESS CREDIT SETUP

What It Includes:

-

Setting up business credit profiles with major bureaus (e.g., Dun & Bradstreet, Experian Business and Equifax Business).

-

Adding tradelines, vendor accounts,and ensuring compliance (EIN, business address, phone number).

-

Aligning your business credit to meet lender expectations for maximum approvals.

Individuals and entrepreneurs with strong personal credit but no established business credit or a poorly set-up company, seeking to secure maximum funding.

Comprehensive Funding Prep (Bundle)

Entrepreneurs starting from scratch with no personal or business credit setup who need a complete solution to become funding-ready.

What It Includes:

-

Setting up business credit profiles with major bureaus (e.g., Dun & Bradstreet, Experian Business).

-

Adding tradelines, vendor accounts, and ensuring compliance (EIN, business address, phone number).

-

Aligning your business credit to meet lender expectations for maximum approvals.

Why Credit Comes First

Funding isn’t just about applying for loans—it’s about being fundable. Whether you have late payments, maxed-out cards, or past collections, we use proven dispute strategies to clean up your credit profile and make you a prime candidate for business funding.

Remove Negative Items

Challenge and eliminate inaccuracies that damage your score.

Lower Credit Utilization

Optimize your profile for better approval odds by removing negative items. If you’ve tried to remove them for free without success, consider settling the accounts instead.

Establish Business Credit to Secure Future Funding

Leverage the expertise we’ve gained from helping over 2,100 businesses secure funding and build successful ventures from the ground up. Build a separate, strong business credit profile & once fundable, Once fundable, we help you obtain capital at great rates.

Testimonials

Michael K, CA

After using this company's service not too long ago, I can say that I am quite pleased with it and that I would strongly suggest it. The clear winner in this category is consistently excellent customer service and communication.

Many thanks for everyone's assistance.

Cheers

Ronald Zampino, MI

I have been hearing about business credit and what you can do with it but anytime I talk to anybody that cleans they knew what they were talking about. They simply didn’t. I talk to the owner and he was very knowledgeable and answered all my questions. Their support department helped us every step of the way, and we had communication with our agent all along Until our business was setup completely, AND THANKS TO DARESHORE.COM, WE WERE ABLE TO DO WHAT WE HAD IN MIND.

The End of Easy Credit Repair: Why the Old Dispute Letters No Longer Work

The Post-CFPB Landscape: An Unseen Shift of Power

For years, credit repair operated in the "easy" era. The Consumer Financial Protection Bureau (CFPB) wielded immense power, pressuring debt collectors and credit bureaus to quickly settle or delete accounts based on simple dispute letters.

Then, the power dynamics changed.

As the CFPB's enforcement power diminished, the entire ecosystem adjusted:

The End of Easy Credit Repair: Why the Old Dispute Letters No Longer Work

The Post-CFPB Landscape: An Unseen Shift of Power

For years, credit repair operated in the "easy" era. The Consumer Financial Protection Bureau (CFPB) wielded immense power, pressuring debt collectors and credit bureaus to quickly settle or delete accounts based on simple dispute letters.

Then, the power dynamics changed.

As the CFPB's enforcement power diminished, the entire ecosystem adjusted:

The Old Era (Pre-Shift)The New Era (Post-Shift)

"Nuisance" Disputes (Simple form letters were enough to force a quick deletion)."Forensic Enforcement" (Generic disputes are now auto-rejected as "frivolous" or "unverified").

Collector Hesitation (Collectors avoided escalation for fear of CFPB fines and scrutiny).Collector Aggression (Collectors are now bolder, relying on automation to stonewall consumers).

Easy Verification (Credit Bureaus were quick to delete errors to close cases).Automated Stonewalling (Bureaus use cheap, automated systems to confirm a debt without real due diligence).

The credit repair process is harder, more complex, and demands proof—not just complaints. The traditional dispute letter is now a powerless piece of paper. You're not fighting a few mistakes; you're fighting a broken, automated system designed to ignore you.

Sample Enforcement Flow (4 of 1,244 Violations)

Introducing the Engine: Your Deterministic Advantage

We built our system for this new reality. This is not a library of templates; it is a complete enforcement framework built on the proprietary knowledge of an Ex-Debt Collector.

The Logic That Forces Compliance

Our framework bypasses the automated rejections by making your demand legally and financially devastating for the furnisher to ignore.

1. The 1,244 ( 1,187+57 Internal ) Violation Engine 🧠

Our AI-driven logic runs 92 Core Triggers that instantly compare your negative mark against 1,244 specific violations across the FCRA, FDCPA, Metro 2, and SPFA. We don't just dispute the debt; we issue a Notice of Violation that leaves no room for automated deflection.

2. Enforcement-First Sequencing

The old way: Dispute to the Credit Bureau (and get ignored).

Our Way (The Foundation Capsule): We force Collector-First Validation to secure the foundational evidence. You use their inevitable failure to validate the debt as the evidence for your next-round dispute with the bureaus. This is how you build a documented, chronologically unassailable case.

3. The Arbitration Lever ⚖️

When disputes and regulatory complaints fail, our system prepares you to deploy the ultimate financial threat: Binding Arbitration. For a consumer, this costs a few hundred dollars. For the collection agency, the cost to defend the claim is thousands of dollars in legal fees. Our method uses this cost asymmetry to force a favorable Conditional Settlement that includes the immediate and permanent deletion of the tradeline.

Choose Your Power Level

We are selling the Forensic Logic—the intelligence, strategy, and evidence trail—to win in this new era.

How We Secure 0% Credit Cards and Funding: Step-by-Step

-

Credit Profile Review

-

We start by analyzing your credit profile to ensure it’s optimized for approval.

-

-

Strategic Applications

-

We apply to multiple issuers that pull from different credit bureaus, reducing the impact of inquiries while maximizing approval odds.

-

-

Funding Approvals

-

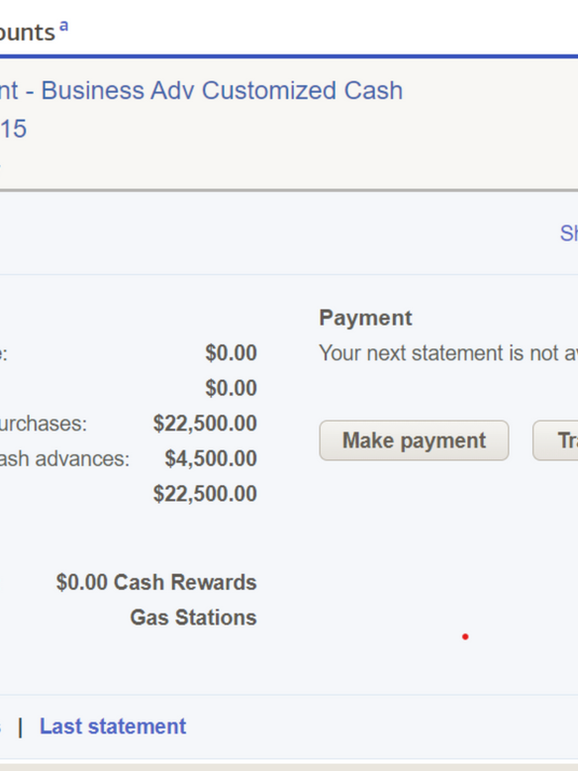

Our method secures multiple high-limit credit cards with 0% APR introductory periods, often totaling $50,000 to $250,000.

-

-

Guidance and Support

-

Once approved, we provide strategies to leverage the funding for growth while managing your credit effectively.

-

Take the first step toward unlocking smarter funding today!

How We Secure 0% Credit Cards and Funding: Step-by-Step

Text Us 949-368-5224