Text Us 949-368-5224

You Don’t Need Credit Repair

You Need Funding Preparation.

Personal Credit Restoration + Business Credit Setup

Become Lendable. Get Funded.

Move Your Business Forward.

Your journey to financial freedom and business funding starts with one crucial step: optimizing your credit profile. At Dareshore, we don’t just repair credit—we strategically position you for long-term financial success so you can access funding when you need it most.

Why Credit Comes First

Funding isn’t just about applying for loans—it’s about being fundable. Whether you have late payments, maxed-out cards, or past collections, we use proven dispute strategies to clean up your credit profile and make you a prime candidate for business funding.

Remove Negative Items

Challenge and eliminate inaccuracies that damage your score.

Lower Credit Utilization

Optimize your profile for better approval odds by removing negative items. If you’ve tried to remove them for free without success, consider settling the accounts instead.

Establish Business Credit to Secure Future Funding

Leverage the expertise we’ve gained from helping over 2,100 businesses secure funding and build successful ventures from the ground up. Build a separate, strong business credit profile & once fundable, Once fundable, we help you obtain capital at great rates.

Build Strong Credit & Unlock Business Funding with Dareshore

FUNDING ASSISTANCE

What It Includes:

-

Expert funding applications and lender negotiations.

-

Guidance on maximizing approvals and securing the best terms.

-

Post-funding support to help you manage and grow your business.

For Entrepreneurs and business owners who need $50K-$250K in funding and already have excellent personal credit and a compliant business profile.

PERSONAL CREDIT RESTORATION

Individuals with no or poor credit who need to remove negative items, add positive history, and rebuild their credit to qualify for funding or other financial opportunities.

What It Includes:

-

Credit Restoration: Fix inaccuracies, remove negative items, and rebuild your credit profile.

-

Debt Settlement: Negotiate and resolve outstanding debts for a fresh financial start.

-

Adding History: Establish aged tradelines to boost your credit profile and meet funding requirements.

BUSINESS CREDIT SETUP

What It Includes:

-

Setting up business credit profiles with major bureaus (e.g., Dun & Bradstreet, Experian Business and Equifax Business).

-

Adding tradelines, vendor accounts,and ensuring compliance (EIN, business address, phone number).

-

Aligning your business credit to meet lender expectations for maximum approvals.

Individuals and entrepreneurs with strong personal credit but no established business credit or a poorly set-up company, seeking to secure maximum funding.

Comprehensive Funding Prep (Bundle)

Entrepreneurs starting from scratch with no personal or business credit setup who need a complete solution to become funding-ready.

What It Includes:

-

Setting up business credit profiles with major bureaus (e.g., Dun & Bradstreet, Experian Business).

-

Adding tradelines, vendor accounts, and ensuring compliance (EIN, business address, phone number).

-

Aligning your business credit to meet lender expectations for maximum approvals.

Why Choose Us

111

Years of Experience

In Business Funding

11

Expert Advisors

2200+

Satisfied Clients

1

Locations

Al Dareshore is the founder of Dareshore, a company specializing in business funding and credit restoration services. Al, an immigrant from Iran, began his journey in the United States in 2007. Like many immigrants, he faced significant challenges and had to learn important lessons along the way. Initially, he damaged his personal credit due to mistakes and inexperience. This compelled him to learn step by step how to restore his credit. In the process, while searching for alternatives to progress, he discovered the world of business credit—a field that later became his primary expertise. With over 12 years of experience in the credit industry, Al transitioned from debt collection to focus on consumer credit restoration. He leveraged his extensive knowledge and personal experiences to help clients overcome financial challenges. He designed a comprehensive system that not only restores personal credit but also enables individuals to benefit from the advantages of business credit. Under Al Dareshore's leadership, Dareshore has expanded its services to include real estate investment, reflecting his multifaceted vision for the company. His commitment to providing straightforward and transparent services, combined with a focus on securing necessary funding for clients, has played a key role in the company’s growth and success. Al Dareshore remains committed to empowering individuals and businesses through financial education and support. He continues to lead Dareshore’s mission, helping clients achieve their financial goals and build a solid foundation for a better future.

Why Dareshore.com?

🚀 Real Expertise

Former debt collectors who know the system inside-out and leverage insider knowledge to challenge negative items effectively.

⚡ No Overpromising

We get you funding-ready, not just “apply and hope.

📈 Long-Term Success

Your future financial freedom starts today.

Testimonials

Michael K, CA

After using this company's service not too long ago, I can say that I am quite pleased with it and that I would strongly suggest it. The clear winner in this category is consistently excellent customer service and communication.

Many thanks for everyone's assistance.

Cheers

J0se Salvador, NY

I appreciate all the care and attention I got from Maria and Al. they are true professionals. Can't wait to get the stuff I can now actually apply for lol

Ronald Zampino, MI

I have been hearing about business credit and what you can do with it but anytime I talk to anybody that cleans they knew what they were talking about. They simply didn’t. I talk to the owner and he was very knowledgeable and answered all my questions. Their support department helped us every step of the way, and we had communication with our agent all along Until our business was setup completely, AND THANKS TO DARESHORE.COM, WE WERE ABLE TO DO WHAT WE HAD IN MIND.

Zhoobin Xena, CA

My personal credit score was 610 when I first started with Dareshore.com. While working on my business credit, Amanda guided me through fixing my personal credit for free. Now, I have a 720 personal credit score and an 88 PAYDEX score!

Shahin Gh, WA

one of the best companies in this industry. very fast responses. happy to have their support and I recommend this company to whoever needs help with their credit.

Jack Martinez, AR

In a world where honesty and dignity from companies in credit repair and debt industry is almost non-existent, it's good to find a company that delivers on what they promise. I am happy to have gotten my apartment after being denied for months.

How We Secure 0% Credit Cards and Funding: Step-by-Step

-

Credit Profile Review

-

We start by analyzing your credit profile to ensure it’s optimized for approval.

-

-

Strategic Applications

-

We apply to multiple issuers that pull from different credit bureaus, reducing the impact of inquiries while maximizing approval odds.

-

-

Funding Approvals

-

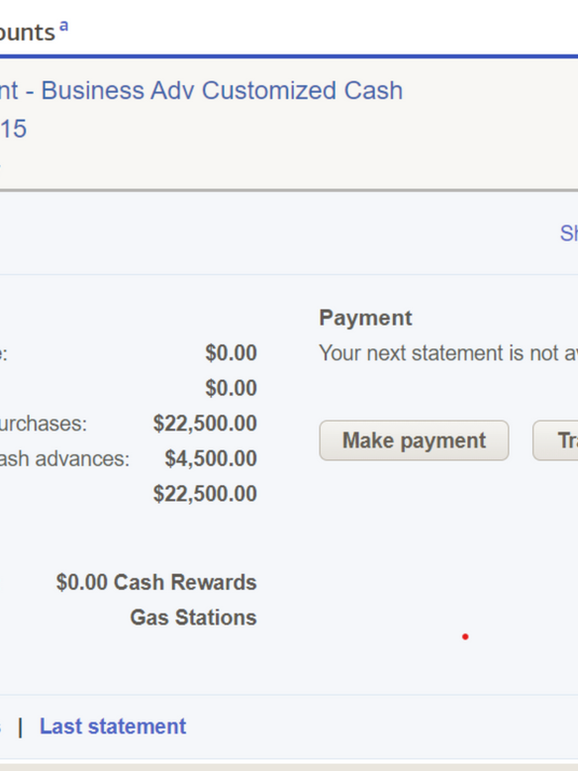

Our method secures multiple high-limit credit cards with 0% APR introductory periods, often totaling $50,000 to $250,000.

-

-

Guidance and Support

-

Once approved, we provide strategies to leverage the funding for growth while managing your credit effectively.

-

Take the first step toward unlocking smarter funding today!

How We Secure 0% Credit Cards and Funding: Step-by-Step

Unlock the Power of Credit

Why Credit Matters

Most people don’t realize how powerful credit really is—and that’s a problem. Credit is the gateway to opportunities, but if you don’t know how to use it, build it, or leverage it, you’re likely to feel stuck, frustrated, and unable to move forward.

But here’s the truth: complaining doesn’t fix anything. Action does.

Personal Credit vs. Business Credit

Did you know there’s a completely separate credit system for businesses? It works differently from personal credit:

-

Business credit reports to separate agencies.

-

It doesn’t interfere with your personal credit.

-

The limits are significantly higher because businesses naturally require more capital.

When set up correctly, personal and business credit can work together to unlock funding opportunities you never thought possible.

What’s Holding You Back?

For many people, it’s one or more of these issues:

-

Personal Credit Problems: Negative marks, too many inquiries, maxed-out utilization, or no credit history.

-

Business Credit Issues: No business entity, lack of a credit profile, or poorly set-up accounts.

These gaps prevent lenders from approving the funding you deserve. Without a clear plan tailored to what lenders expect, it’s nearly impossible to move forward.

Our Proven Solution

That’s exactly why we developed a step-by-step system to address every challenge. Over the years, we’ve seen people with tremendous potential stuck because they didn’t know where to start. Some lacked business credit; others didn’t even have a business entity.

Our process tackles it all:

-

Cleaning up personal credit (removing negatives, settling debts, and adding tradelines).

-

Building or fixing business credit to establish a strong financial foundation.

-

Aligning everything with what banks and lenders look for when approving applications.

How We Work

Every client starts with a Financial X-Ray—a deep dive into both personal and business credit to identify what’s holding you back.

-

Step 1:

-

We specialize in deletion demand dispute letters, using a strategic, reverse-engineered process to challenge credit bureaus and creditors to prove the accuracy of negative items. In most cases, they fail to do so, resulting in the removal of those items. Unlike generic templates that can harm your credit score, our letters are crafted with insider expertise by a former debt collector, designed to clean up your credit effectively and responsibly.

-

Unlike other companies that mishandle credit optimization, we begin by challenging every negative item to maximize removals, particularly for accounts with no assets or those already in the negative. If removal isn’t immediate, we accelerate the process by issuing a cease-and-desist letter and targeting debt collection agencies to uncover violations. These violations are then leveraged to pursue arbitration, compelling collectors to comply or face legal consequences. For clients facing financial hardship and unable to pay bills, we recommend exploring bankruptcy as a viable option. If your credit is already severely damaged, we advise prioritizing payment of valid debts while simultaneously identifying violations, exercising your legal rights, and securing removals. Our proven method delivers faster, more effective results in the post-CFPB era.

-

Step 2: Business Credit Setup

-

Once your personal credit is strong, we help you establish business credit so lenders see you as low-risk. Our packages include DIY guides, expert support, and exclusive forums for guidance.

-

Step 3: Funding Readiness & Success

-

Even if you’re not ready for funding today, we set you up so you can access high-limit business credit lines and loans whenever you choose. No rush. No pressure. Just funding on your terms.

It’s Easier Than You Think

You might think your credit is a disaster, but in most cases, the problems can be fixed faster than you expect. Often, people don’t realize that:

-

Credit restoration can remove negative marks and settle debts.

-

Adding tradelines can boost credit profiles significantly.

-

Starting early can create the history banks want to see when you’re ready to apply for funding.

Why Now Is the Best Time

Even if you’re not ready to start a business today, building credit history now positions you for success later. Banks want to see responsibility: paying taxes, maintaining accounts, and showing revenue—even small amounts—are essential.

If you don’t have a business idea, we can help with proven plans in successful industries to get you started.

Our Results Speak for Themselves

We’ve helped over 2,100 people and businesses achieve their funding goals, even when they thought it wasn’t possible. The process works, and the results are real.

Ready to Take Action?

Waiting won’t improve your credit or build your business. Action will. The opportunity is here, and with our proven system, we’ll meet you where you are and guide you every step of the way.