The End of Easy Credit Repair: Why the Old Dispute Letters No Longer Work

The Post-CFPB Landscape: An Unseen Shift of Power

For years, credit repair operated in the "easy" era. The Consumer Financial Protection Bureau (CFPB) wielded immense power, pressuring debt collectors and credit bureaus to quickly settle or delete accounts based on simple dispute letters.

Then, the power dynamics changed.

As the CFPB's enforcement power diminished, the entire ecosystem adjusted:

The credit repair process is now harder, more complex, and demands proof. not just complaints. The traditional dispute letter is now a powerless piece of paper. You're not fighting a few mistakes; you're now fighting a broken, automated system designed to ignore you.

This is the copy that positions your product as the essential solution for the new, tougher credit repair landscape, leveraging the post-CFPB power shift as your main selling point.

The copy is designed for a landing page, using strong headings, emotional hooks, and a clear call to action (to purchase the logic).

The End of Easy Credit Repair: Why the Old Dispute Letters No Longer Work

The Post-CFPB Landscape: An Unseen Shift of Power

For years, credit repair operated in the "easy" era. The Consumer Financial Protection Bureau (CFPB) wielded immense power, pressuring debt collectors and credit bureaus to quickly settle or delete accounts based on simple dispute letters.

Then, the power dynamics changed.

As the CFPB's enforcement power diminished, the entire ecosystem adjusted:

The Old Era (Pre-Shift)The New Era (Post-Shift)

"Nuisance" Disputes (Simple form letters were enough to force a quick deletion)."Forensic Enforcement" (Generic disputes are now auto-rejected as "frivolous" or "unverified").

Collector Hesitation (Collectors avoided escalation for fear of CFPB fines and scrutiny).Collector Aggression (Collectors are now bolder, relying on automation to stonewall consumers).

Easy Verification (Credit Bureaus were quick to delete errors to close cases).Automated Stonewalling (Bureaus use cheap, automated systems to confirm a debt without real due diligence).

The credit repair process is harder, more complex, and demands proof—not just complaints. The traditional dispute letter is now a powerless piece of paper. You're not fighting a few mistakes; you're fighting a broken, automated system designed to ignore you.

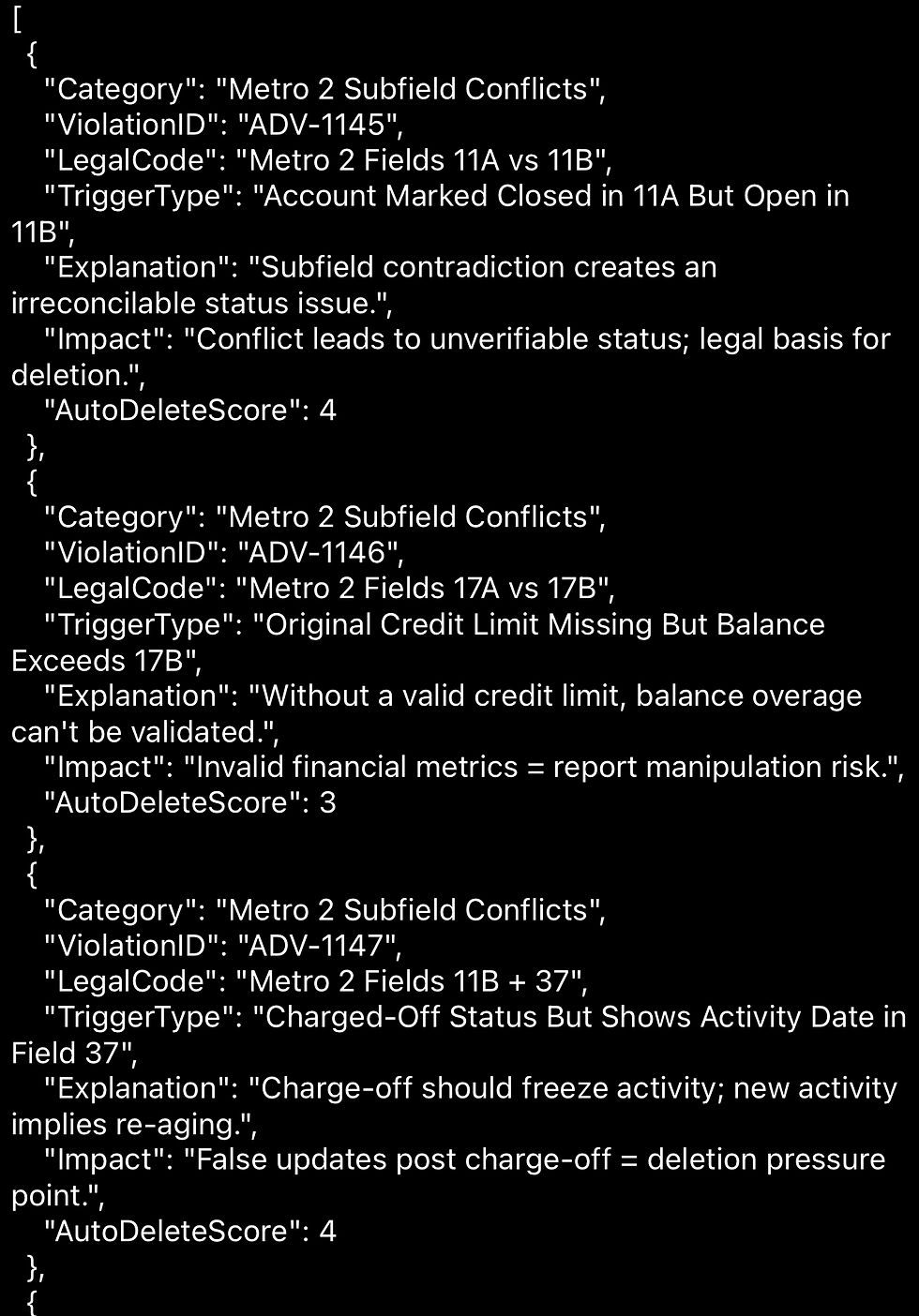

Sample Enforcement Flow (4 of 1,244 Violations)

Introducing the Engine: Your Deterministic Advantage

We built our system for this new reality. This is not a library of templates; it is a complete enforcement framework built on the proprietary knowledge of an Ex-Debt Collector.

The Logic That Forces Compliance

Our framework bypasses the automated rejections by making your demand legally and financially devastating for the furnisher to ignore.

1. The 1,244 Violation Engine 🧠

Our AI-driven logic runs 92 Core Triggers that instantly compare your negative mark against 1,244 specific violations across the FCRA, FDCPA, Metro 2, and SPFA. We don't just dispute the debt; we issue a Notice of Violation that leaves no room for automated deflection.

2. Enforcement-First Sequencing

The old way: Dispute to the Credit Bureau (and get ignored).

Our Way (The Foundation Capsule): We force Collector-First Validation to secure the foundational evidence. You use their inevitable failure to validate the debt as the evidence for your next-round dispute with the bureaus. This is how you build a documented, chronologically unassailable case.

3. The Arbitration Lever ⚖️

When disputes and regulatory complaints fail, our system prepares you to deploy the ultimate financial threat: Binding Arbitration. For a consumer, this costs a few hundred dollars. For the collection agency, the cost to defend the claim is thousands of dollars in legal fees. Our method uses this cost asymmetry to force a favorable Conditional Settlement that includes the immediate and permanent deletion of the tradeline.

Choose Your Power Level

We are selling the Forensic Logic—the intelligence, strategy, and evidence trail—to win in this new era.

Founder’s Release Pricing — Limited Time. Prices will increase soon.

Tier 1 — The Catalyst Engine

۹۷٫۰۰$92 core triggers, Each blooms into multiple violation paths once Ai runs the logic. Each negative mark is compared against 400+ individual violations or code combos. Built for the Post-CFPB power era.- Forensic Logic File For ChatGPT Made By Ex-Debt Collector

- 400+Code Violation Library FCRA/FDCPA /Metro 2 /SPFA / Logic

- Built-in logic for Letter generator In forensic logic file

- Mail & ID Verification Checklist-prevents address mismatches

- Best Value

Tier 2 — The Foundation Engine

۴۹۷٫۰۰$Built for users who want to stay in control of their credit repair journey in the post-CFPB era. offers a concise version of the full enterprise system, showing the whole map (dispute to resolution.)- Everything in the Consumer Catalyst Kit.

- Summary of the Comprehensive Playbook (Map of every stage)

- Future Rounds Reply Map. Built from Collector & CRA answers

- 1st-Round Letter Generator. AI Logic & letter Structure file

- Dispute Flow Charts - sequence, and escalation check points

- How to choose your next move Booklet (How to answer)

- Collector and DBA Conflict Analysis Text File

- Timing & Mailing Planner — Dispute Checklist & Tracker

Tier 3 — Precision Engine ( TOP SELLER )

۸۹۷٫۰۰$The complete enforcement framework. every violation, every logic, every round. No guessing. Built for credit repair pros, debt settlement firms, law offices, and coaches operating In the post-CFPB era- DBA Conflict Check Tool – find ownership mismatches

- Post-CFPB Credit Repair Playbook A-Z| Follow-Through Logic

- Full Violation Intelligence Framework (1,187 entries)

- DBA Conflict Checker txt file + Collector Chain Mapping.

- Letter Generator Blueprint for different rounds & Situations

- Violation Matrix (Expanded) - Deep explanations

- Multi-Round Reply Map - Response Intelligence Library

- Collector Tactics Booklet

- Evidence & Proof Trail Kit

Tier 4 — The Empire Engine

۳٬۹۹۷٫۰۰$For established agencies & builders who want automation & scalability .This is the full engine, backend logic, automation scripts, & compliance infrastructure. enforces determinism, & runs airtight.- Everything in the Precision Engine Capsule.

- Backend Automation System + Secure Storage Flows.

- Developer-Ready Logic Pack

- Developer‑ready integration maps

- Front-End UI Flow, Operational Sequencing & Handoff Logic

- Deterministic AI engine guardrails

- Compliance Proof Tracker + Audit Logs

- Payment Hooks + License Enforcement Logic

- White‑Label license for agency use

- Audit logs and multi‑stage verification checks

- Python Guardrails Fixes Hallucination / RAG Drift

- Affidavit Auto-Builder

- Contract & Arbitration Clause Extractor

- Adaptive Violation Classifier (AI-driven)

- Identity Verification & Matching Engine

- Multi-Path Response Router

- Performance Analyzer – tracks success rates per violation

- OCR + PDF Extractor file converts reports into analysis

- Business-in-a-Box Compliance System

- ★ Our Dev Team can build & wire your system (as an add-on).

- ★ Voice Agent Closer (as an add-on)

- ★ Web Portal CRM (as an add-on)

- ★ Affiliate Portal (as an add-on)

- ★ Maintenance Support (as an add-on)

- ★ AI Funding Flow (Business Credit Builder Engine – add-on)

A structured closing section used in advanced dispute letters. It establishes legal authority, defines non-compliance consequences, and opens a path for resolution. Functions: Frames the collector’s duties under FCRA §1681n & FDCPA. Lists enforcement paths: binding arbitration, regulatory complaints, broader public actions. Issues a cease-and-desist clause (FDCPA §805/§1692c). Ends with a resolution offer — deletion within 30 days avoids further action. Purpose: Tightens the dispute into a f

A structured JSON record of individual Metro-2 Subfield Conflicts. Fields: Violation ID – unique reference (e.g., ADV-1145) Legal Code – governing rule or field set (e.g., “Metro 2 Fields 11A vs 11B”) Trigger Type / Explanation / Impact / AutoDelete Score – forensic analysis and severity rating Purpose: Drives the automated letter logic and scoring system that decides which tradelines qualify for deletion faster or enforcement escalation.

A structured closing section used in advanced dispute letters. It establishes legal authority, defines non-compliance consequences, and opens a path for resolution. Functions: Frames the collector’s duties under FCRA §1681n & FDCPA. Lists enforcement paths: binding arbitration, regulatory complaints, broader public actions. Issues a cease-and-desist clause (FDCPA §805/§1692c). Ends with a resolution offer — deletion within 30 days avoids further action. Purpose: Tightens the dispute into a f